Energa Group posts robust financial results and stable growth prospects

Energa Group posts robust financial results and stable growth prospects

The Energa Group reports robust financial results in 2015 in all business segments and continues to improve its results in the Distribution Segment, which is of crucial importance for its earnings. The Energa SA Management Board has published its financial statements for last year. In its assessment the Energa Group has stable growth prospects despite unfavorable market conditions.

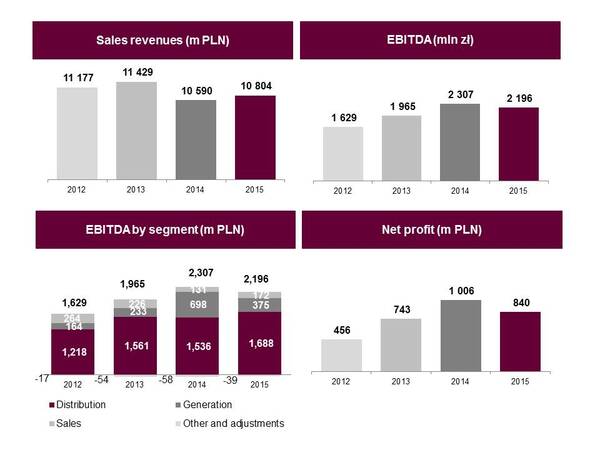

Consolidated results are slightly down from 2014 when market circumstances were exceptionally conducive. Comparing results in recent years, clear stable growth is visible when measured by EBITDA and net profit. From 2012 to 2015 EBITDA rose on average by 10% and net profit rose by 23%*. This confirms the Group’s sound and stable financial position.

“Last year was a challenging period for Energa in connection with changes taking place in the market and regulatory environment. Having regard for the conditions the Group faced in its various business areas, each segment has managed to generate robust results at the very least. In the last several years Energa has recorded very stable growth. The Group’s financial position is very sound, making it possible to pursue the strategic objectives we will define in the middle of this year”, says Dariusz Kaśków, President of the ENERGA SA Management Board.

The Energa Group’s revenues last year were PLN 10.8 billion, up 2% compared to 2014. The more challenging market conditions contributed to EBITDA shrinking by 5% to PLN 2.2 billion, while net profit was PLN 840 million as opposed to PLN 1 billion in 2014, an exceptional year in terms of earnings.

The following factors contributed to the 2015 results:

- Improvement in the Distribution Segment - achieved thanks to the higher average distribution rate, higher connection fee revenues and higher energy demand.

- Growth in the Sales Segment - attained by generating a higher margin on electricity sales, chiefly by expanding the product offering for clients and lower costs of property rights.

- Lower results in the Generation Segment - caused by market factors, extremely difficult hydrological conditions and the overhaul of one of the power units in the Ostrołęka Power Plant coupled with lower demand for must run production for PSE, the Polish Power Grid.

2015 segmental results

In the Distribution Segment Energa generated very robust results. EBITDA was 10% higher than in 2014 and amounted to PLN 1.7 billion. Revenues rose 6% to PLN 4.3 billion. The significant improvement in this area was an effect of the higher volume of transmitted energy and the higher rate of sales for distribution services. As a result of connecting a higher number of wind farms and traction sub-stations for PKP, connection fee revenues surged up 58%.

The Generation Segment’s results were under pressure exerted by market factors. This area’s EBITDA was PLN 375 million compared to PLN 698 million in 2014. Sales revenues were PLN 1.4 billion compared to PLN 1.8 billion in the previous year. The deterioration in results was caused by lower prices for property rights (the market price for green certificates plummeted by 1/3), extremely difficult hydrological conditions that affected electricity generation in hydro power plants and the overhaul of one of the power units in the Ostrołęka Power Plant coupled with lower demand for must run production for PSE, the Polish Power Grid. This impact was mitigated by the higher efficiency of conventional power units and the falling unit cost of coal and biomass.

The Group enhanced the return generated by the Sales Segment. EBITDA climbed 31% to PLN 172 million on revenues of PLN 5.7 billion, nearly matching the previous year’s level. Last year, a higher margin was recorded on the sales of energy, chiefly thanks to the lower unit cost of redeeming property rights. This improvement also comes from work done on the product offering. In 2015 gas sales developed driving up sales volume several times year on year. This is one of the strategic directions for the development of Energa-Obrót. This offer is based on the dual fuel concept, i.e. selling electricity in conjunction with natural gas. This solution is very favorable and convenient to business clients and private individuals. The costs associated with Energa-Obrót acting in the capacity of “Offtaker of Last Resort”, i.e. buying energy generated in renewable energy sources on the local market at the price set by the ERO President, continued to exert an adverse impact on the Segment’s results.

Higher volume of transmitted energy, lower production in more challenging conditions

At the end of 2015, the total installed generation capacity in the Energa Group was 1.4 GWe, with 41% being renewable sources.

The Group generated 4.1 TWh of gross electricity, compared to 5.1 TWh generated in the previous year. This decline was primarily driven by challenging hydrological conditions and lower production in the Ostrołęka Power Plant. The latter was associated with the scheduled overhaul of one of the power units and the lower demand for the operation of this power plant for the Transmission System Operator.

RES production in 2015 was down 4% to 1.7 TWh. This resulted mainly from the extremely difficult hydrological conditions in the summer months. As a result of greater windiness and additional production from the new Myślino wind farm, electricity generation in wind-driven power plants rose 36%.

The volume of electricity transmitted by Energa-Operator was up 3% over 2014 at above 21.5 TWh.

The sales of electricity to end-users remained edged up 2% to 16.8 TWh.

Investments in 2015 - grid expansion and power unit modernization in Ostrołęka

In 2015 Energa spent PLN 1.6 billion on investments in Poland. Projects to expand and modernize the distribution grid were executed according to plan and the Group spent PLN 1.1 billion for that purpose.

These investments aim to curtail energy losses in transmission and to improve the reliability of supply constantly, thereby supporting the entire electrical power system’s security. In 2015:

- 30 thousand new customers were connected,

- 4,383 km of medium voltage and low voltage lines were built and modernized,

- 937 new renewable energy sources were connected to the grid,

- the third stage of installing AMI smart meters was continued - this stage pertains to the installation of 450 thousand meters (the first deliveries and installation during the third stage commenced in November 2014).

In the Generation Segment, capital expenditures were PLN 392 million and involved tasks related to improving the efficiency of one of the power units in Ostrołęka Power Plant B and to adapting equipment to restrictive EU regulations.

Capital expenditures were also associated with RES generation capacity development projects: the ongoing construction of the Parsówek wind farm with a capacity of 26 MW and completing the construction of the Czernikowo photovoltaic power plant with a capacity of 4 MW in October.

2016 - work to strengthen its competitive position

It is the Energa Group’’s ambition to be the leader among distribution system operators. The key investments in 2016 will be related to executing initiatives to enhance continuity of supply ratios and to implementing a smart metering system. The Group is developing the most sophisticated smart grid projects in Poland and it is the leader in installing electricity consumption smart meters without which it would not be possible to implement new solutions in the energy sector that are favorable to clients and the company, alike.

In 2016 the RES generation portfolio will expand to include the Parsówek wind farm. In the generation area the project to modernize the Ostrołęka B Power Plant will also be continued for it to meet more stringent environmental requirements, through further construction of a nitrogen oxide reduction installation and installation of electrostatic precipitators.

In electricity sales active measures are being taken to increase the number of clients and drive up profits. Energa is honing its product offer by embracing innovative customer and environmentally-friendly solutions. Improvements are being implemented to enhance the effectiveness of sales activities and to augment the quality of customer service, guaranteeing satisfaction of the main customer expectations at the lowest possible cost.

* On the basis of the cumulative annual average gross rate (CAGR).